48+ how does paying extra principal affect mortgage

How Much Interest Can You Save By Increasing Your Mortgage Payment. This means you can make half of your mortgage payment every two weeks.

Scan Magazine Issue 129 October 2019 By Scan Client Publishing Issuu

Make one extra payment every year.

. Web This means that every extra dollar you pay now will save you 248 348 1 over the lifetime of the mortgage. You could for example pay an extra 50 or 100 each month or make one extra. This method reduces the total amount of interest you pay while helping you fast-track your mortgage payoff.

That results in 26 half-payments which equals 13 full monthly payments each year. Just paying an additional 100 per month towards the principal of the mortgage reduces the number of months of the payments. Web So instead lets imagine you increased your mortgage payment by 112th 175 each month.

Web Making additional principal payments will also shorten the length of your mortgage term and allow you to build equity faster. Web Ways to pay down your mortgage principal faster. Web Simply paying a little more towards the principal each month will allow the borrower to pay off the mortgage early.

Making Extra Mortgage Payments Most mortgages provide you the option to pay extra on your principal if you wish. With the same 6 interest rate youd end up paying 2273 instead of 2098. Similarly it is asked why does so much of my mortgage payment Go to interest.

If you prepay 1000 on your mortgage the interest next month will be reduced by 100037123083 You will still make the same payment but an additional 3083 will be credited toward principal. Ad Finance raw land with fixed or variable rates flexible payments and no max loan amount. Making just one extra payment towards the principal of your mortgage a year can help take years off the life of your loan.

Because your balance is being paid down faster youll have fewer total payments to make in-turn leading to more savings. Get an idea of your estimated payments or loan possibilities. Web How many years does making an extra mortgage payment take off.

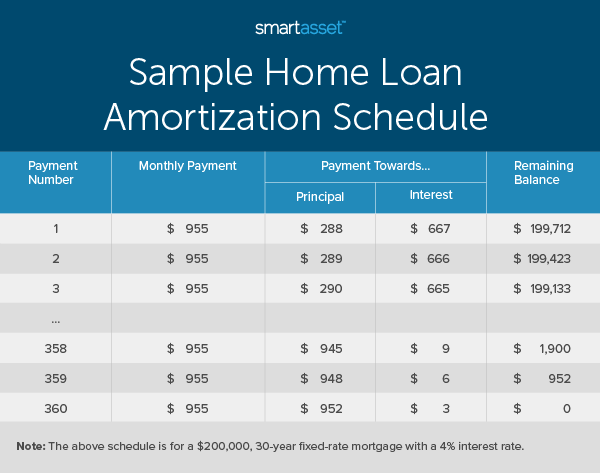

Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Web This process of balancing out the principal and interest each month to keep your payments at a steady amount is called amortization. It has a positive effect upon your mortgage.

Try our mortgage calculator. Based on our example above that extra payment can knock four years off the 30-year mortgage and save you. Since you payment is based on the interest accrued since the past payment your interest will be lower.

The results are nearly identical although making an extra mortgage payment at the end of the year saves you more money on interest. Web If you prepay your mortgage you reduce the principal balance reducing the interest due next month and every month forward. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Web A principal-only mortgage payment also known as an additional principal payment is a supplementary payment applied directly to your mortgage loan principal amount. So if your balance was 100000 and you should have paid 500 to principal but you paid 600 next months interest will be based on 99400 instead of 99500. Save on interest Since your interest is calculated on your remaining loan balance making additional principal payments every month will significantly reduce your interest payments over the.

Web Most mortgages if you pay over the payment amount the excess goes to principal. Web Paying extra on a mortgage may help reduce the amount of interest paid over time in addition to the total amount of time it takes to pay back your mortgage. It exceeds the scheduled monthly amount possibly saving you on interest and helping you to pay off your mortgage early.

Time Frame The amount that an extra monthly. Web As we mentioned above when paying extra on a mortgage while keeping the amortization term the same the extra cash directly reduces the mortgage balance which constitutes the principal part of the loanThe immediate effect of the additional principal payment is the reduction of mortgage balance which is the base of the. Web A principal-only mortgage payment also known as an additional principal payment is a supplementary payment applied directly to your mortgage loan.

A 30 year mortgage can be reduced to about 24 years this represents a savings of 6 years. Web So what is the effect of paying extra principal on a mortgage. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

You may be able to reduce the amount of interest paid and the time it takes to pay back your mortgage by applying extra payments directly to the principal balance. This means that every extra dollar you pay now will save you 248 348 1 over the lifetime of the mortgage. Web which is just over 348.

Should You Make An Extra Mortgage Payment Firstbank Mortgage

Which Mortgage Is Better 15 Vs 30 Year Home Loan Comparison Calculator

Early Mortgage Repayment Calculator Paying Extra On Your Home Loan With Bi Weekly Payments

The Pros And Cons Of An Extra Mortgage Payment Fountain Mortgage

Why Are Mortgage Payments Mostly Interest

Extra Mortgage Payment Calculator What If I Pay More

Should You Make Extra Mortgage Payments Compare Pros Cons

Sterling September 2019 European P2p Lending Portfolio Update P2p Millionaire

When Do Homeowners Pay More In Principal Than Interest 2021 Study Smartasset

Pdf Climate Science Denial And The Declaration Of Delhi Alistair Woodward Academia Edu

48 Sample Loan Agreements In Pdf Ms Word Excel

Free 11 Sample Debt Payoff Calculator Templates In Pdf

48 Sample Loan Agreements In Pdf Ms Word Excel

Mortgage Calculation Should I Make Extra Payments Fidelity

Playtimes The School Book Hong Kong 18th Edition By Playtimes Magazine Hong Kong Issuu

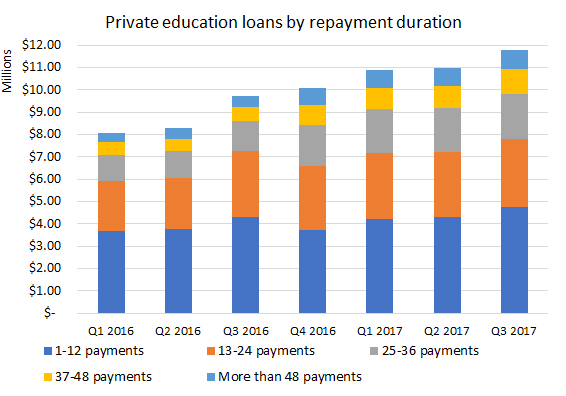

Shorting The Student Loan Bubble With Sallie Mae Nasdaq Slm Seeking Alpha

Is Prepaying Your Mortgage A Good Decision Bankrate

Komentar

Posting Komentar