24+ Monthly mortgage payment

So to estimate the effect of making accelerated biweekly payments you just include an amount in the Extra Monthly Payment field equal to the Monthly Payment divided by 12. Whats the monthly payment of a 150000 loan.

Loan Document Free Printable Documents Contract Template Private Loans Loan

However the trade-off for that low payment is a significantly higher overall cost because the extra.

. The 30-year mortgage is the most popular choice because it offers the lowest monthly payment. Save Saved Removed 1. The formula for mortgage basically revolves around the fixed monthly payment and the amount of outstanding loan.

It can be used for any type of loan like a car home motorcycle boat business personal student loan debt credit card debt etc. An annuity is based on. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

Then follow across to the payment factor for either a 15 or 30 year term. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 47742 a month while a 15-year might cost 73969 a month. For the Payment column enter the first three payment numbers eg 0 1 2.

Mortgage calculator - calculate payments see amortization and compare loans. Calculate your mortgage payment schedule and how to save money by making prepayments. Mortgage Refinance Calculator.

Multiply the factor shown by the number of thousands in your mortgage amount and the result is your monthly principal and interest payment. For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 1257 monthly payment. Anna 2021-10-24 2002 0.

And its one of the main things that creditors look at. V Loan amount. In effect you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow.

30-Year Fixed Mortgage Calculator. So the biweekly method has you making two extra payments each year which is the same as making one extra monthly payment. P Vn1 nt1 nt - 1 Where.

Your report card shows your grade total late payments and more. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. This calculator will also help to determine how different interest rates and levels of personal income can have an.

Payment history is the record of whenand ifyou pay your bills. But as youre about to discover you will certainly notice the increased cash flow that will occur when you pay your mortgage off way ahead of schedule. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

The accelerated amount is slightly higher than half of the monthly payment. See your payment history. In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage.

Scan down the interest rate column to a given interest rate such as 7. The formula used to calculate monthly principal and interest mortgage payments is. Estimate your monthly loan repayments on a 250000 mortgage at 4 fixed interest with our amortization schedule over 15 and 30 years.

These free online calculators will help you find out how much your monthly payment on Cenlar Mortgage will be. 15-Year Fixed Mortgage Calculator. Thats one extra monthly payment a year.

The fixed monthly mortgage repayment calculation is based on the annuity formula Annuity Formula An annuity is the series of periodic payments to be received at the beginning of each period or the end of it. For instance if your. 150k over 15 years at 025.

Use this calculator to find the monthly payment of a loan. In the date column youll input the date on which you take out the loan as well as first two dates upon which you plan to make the monthly payment eg 212005 312005 and 412005. For example the accelerated bi-weekly payment allows you to pay half of your monthly payment every two weeks.

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. As a result by the end of the year youll pay an equivalent of 13 monthly payments. Youd end up making 26 payments instead of 24 within a year resulting in prepayments on the principal equivalent to one monthly payment.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. With this unique 4 column format you can compare scenarios side-by-side print amortization schedules and plan your payoff strategy. The more common of the two is the 801010 mortgage arrangement in which the home buyer is granted an 80 percent loan-to-value LTV on the primary mortgage and 10 percent LTV on the second mortgage with a 10 percent down payment.

Assuming you have a 20 down payment 70000 your total mortgage on a 350000 home would be 280000. T Total number of payments term of loan in months. Amortization means that at the beginning of your loan a big percentage of your payment is applied to interest.

JULY 24 2019 My loan was submitted ON OR AFTER JULY 25 2019. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. This can add up to significant savings over the course of the mortgage.

Find a Loan Officer Near You. Other costs and fees related to your mortgage may increase this number. See your payment history now.

What is Mortgage Formula. You can use a formula for this by. UpdateCenlar Mortgage Payment - 20210506.

Todays national mortgage rate trends. Once you input your monthly obligations and income the Maximum Mortgage Calculator will calculate the maximum monthly mortgage payment and total mortgage amount that you can afford based on your current financial situation. Given that there are 12 months and 52 weeks in a year paying 26.

Monthly Mortgage Payment Calculator. The loan is secured on the borrowers property through a process. The piggyback second mortgage can also be financed through an 8020 loan structure.

For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. Payment history makes up 35 of your credit scorethe biggest part. P Monthly payment amount.

For example a 6 APR becomes 0. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000. You will therefore make 26 payments a year the equivalent of one extra monthly payment a year.

Using The Mortgage Payment Table. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. You can also see the savings from prepaying your mortgage using 3 different methods.

With each subsequent payment you pay more toward your balance. If you were to make two payments a month that would be just 24 payments in a year. N Monthly interest rate as a decimal This is the annual interest rate divided by 12.

Set up the first three cells in your Date and Payment Number columns. Also this calculator has the ability to add an extra amount extra payment to the monthly mortgage and turbo charge your interest savings. The real magic of the biweekly payment comes from the fact that there are 52 weeks in a year giving you 26 total payments.

24 April 2020 Quote Calendars Calendar Printables Calendar Pages Calendar Template

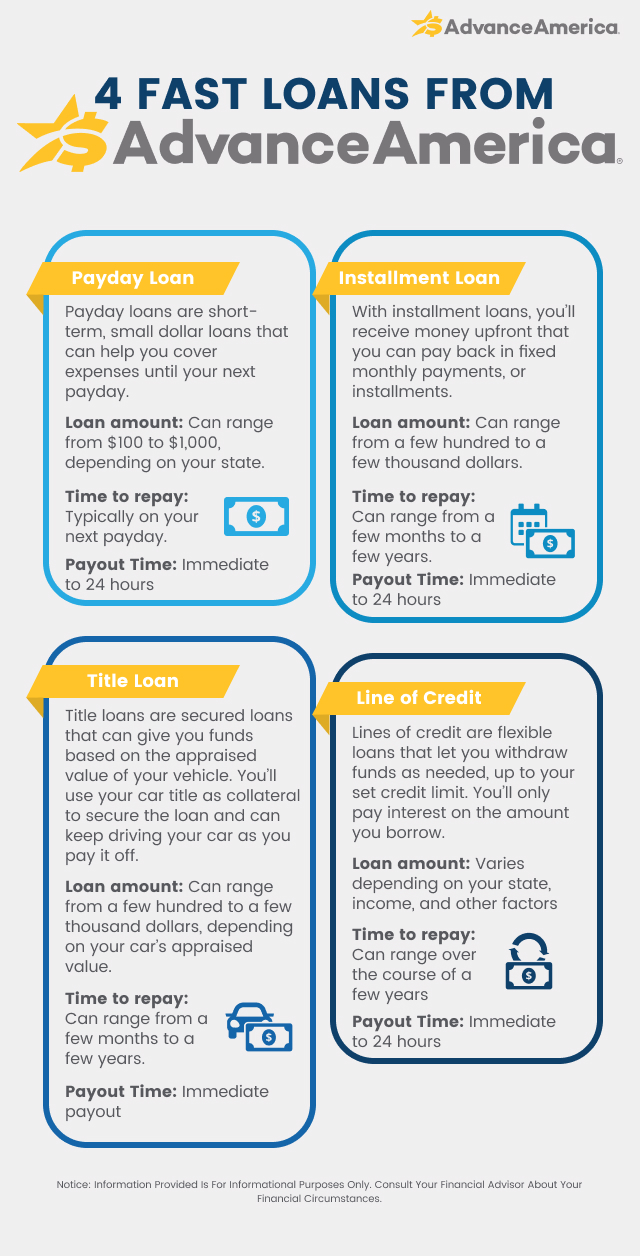

How To Borrow Money Fast Money Loans Advance America

Uploan Philippines Get Your Loan In 24 Hours Up To 100000 Advance Loans Loan Get A Loan The Borrowers

Simple Balance Sheet 24 Free Word Excel Pdf Documents Download Free Premium Templates

Sample Household Budget Worksheet Household Budget Template Budget Planner Template Budget Template Printable

Sustained Credit Card Borrowing Grodzicki 2021 Journal Of Consumer Affairs Wiley Online Library

10 Excel Budget Templates Free Sample Example Format Download Excel Budget Template Excel Budget Budget Template

How To Get Out Of Debt Pay Off Debt Or Save Advance America

20750 Lost Ranch Rd San Jose Ca 95120 Zillow Luxury Homes Dream Houses Mansions House Exterior

Debt To Income Ratio Advance America

Holiday And Christmas Loans Advance America

Installment Loans For Bad Credit Advance America

24 Free Daily Schedule Templates Daily Planners Word Excel Pdf Daily Schedule Template Daily Calendar Template Daily Planner Template

2

Free 24 Sample Payment Schedules In Pdf Ms Word

Pin On Things For My Wall

Explore Our Sample Of Personnel File Checklist Template For Free Onboarding Checklist Checklist Template Employee Onboarding

Komentar

Posting Komentar